As your business grows, building your team is an exciting new stage! This is when you really start to feel like you’re growing, and open up new opportunities and perspectives within your business. Setting up your team with the right legals is setting your business up for success.

As you might have seen on the news with other businesses, non-compliance with employment law can be very damaging to your brand and have catastrophic consequences for the business. So it is very important that you are aware of your obligations as an employer.

Employees and contractors

There are two main ways to build your team – hiring employees or engaging contractors. There is an important conceptual difference between the two – an employee has a special status as part of the business, whereas a contractor runs their own business (i.e. they normally have their own ABN and may invoice you for their work).

Even if someone is called a contractor, if the relationship resembles an employment relationship in substance, then they are considered an employee under law and the relevant obligations apply. Many businesses try to treat employees as contractors – often to avoid paying minimum wage and superannuation – but this is called ‘sham contracting’ and heavy penalties for engaging in this behaviour, so don’t do it!

You can find out more about contractors and employees on the New Zealand government’s Employment New Zealand website.

Contractor Agreements

If you’re engaging contractors, you need a Contractor Agreement. A Contractor Agreement is very similar to a Service Agreement/ Business Terms & Conditions, discussed in Chapter 7. Key things to be clear about are – scope of the work, payment and dispute resolution.

Employment Contracts

It is essential that you enter into an Employment Contract with each of your employees. A good contract will cover important matters such as salary, leave, probation periods, ownership of intellectual property, confidentiality and termination rights. You may also want to include restraint and/or non-solicitation clauses, to restrict the ability of employees to leave and poach your customers and staff.

You can obtain a copy of casual, part-time and full time templates from Employment New Zealand. However, these will not provide much in the way of business protection as they tend to be favourable to employees. Alternatively, you can speak to us about drafting an Employment Contract for your business.

Some other things that should be part of your Employment Contracts and procedures are outlined below.

Employment law – areas to consider

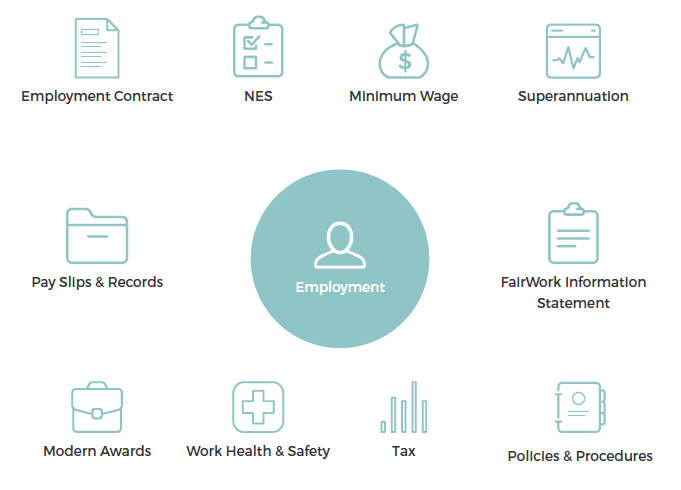

We’ve created the visual map which sets out the key areas of employment law for you to consider.

Types of employees

The three types of employees are casual, part-time and full-time. Employees receive different minimum entitlements depending on whether they are casual, part-time or full-time employees. In addition, some of these entitlements are only available once an employee has reached a certain minimum period of employment with the same employer. You should be aware of these minimum entitlements and ensure they are provided to the relevant employees.

For more details, have a read through these details on the Employment New Zealand website.

Employment Standards

All employees in New Zealand are entitled to minimum conditions under the Employment Relations Act 2000 and Holidays Act 2003, covering things like leave, flexible working practices, and annual leave requirements. You should be aware of these conditions and ensure that your business is compliant in the way you treat your employees.

Minimum wage

Employees must be paid at least the minimum wage. The minimum wage rates are reviewed every year. For current rates and information see here.

Kiwisaver

Employers must contribute to an employee’s KiwiSaver retirement savings scheme if the employee is a member. The current contribution rate is 3%.

More information on this topic is available here.

Pay slips and records

Pay slips have to be given to an employee within 1 working day of pay day, even if an employee is on leave. You are required by law to keep certain written time and wage records for each employee. These records must be kept for at least seven years.

Visit Employment New Zealand for information on what records you need to keep.

Tax

As an employer, you need to meet tax obligations for all workers. In particular, you must determine the tax rate to withhold from payments you make to your employees so they can meet their taxation obligations. This is done through the PAYE (Pay As You Earn) system.

Some employers will also have to enrol in the ACC (Accident Compensation Corporation) WorkPlace Cover to provide support in case of workplace injuries.

Visit the Inland Revenue Department for more information. You should also speak to your tax advisor to make sure you are complying with your tax obligations.

Health and Safety at Work

As mentioned in Chapter 5, as an employer you are required by law to provide a healthy and safe working environment. This includes identifying and managing risks, providing the right tools and training for the job, and ensuring there is a process for dealing with injuries and emergencies.

Policies and procedures

It is a good idea to create a staff handbook for your business, setting out policies and procedures covering certain matters. In particular, there are laws governing workplace discrimination, sexual harassment and workplace bullying. Having a staff handbook containing robust policies can assist in promoting proper conduct in your workplace – and also provide you with recourse where your employees breach the policy.

Employment New Zealand has some useful guides about harassment, bullying and discrimination in the workplace.

Employment Information Statement

You must give every new employee a copy of the Employment Information Statement, before, or as soon as possible after, they start their new job. This is a requirement under the Employment Relations Act 2000.

In conclusion…

In this chapter we’ve learned about the legal steps required to build your business’ team. There are a lot of important legal requirements when hiring employees and contractors. Getting this right means both you and your team are protected, and you can work together to focus on the important stuff that makes your business tick. If you need advice preparing Contractor Agreements, Employment Contracts – or just understanding any of your employment law obligations – feel free to get in touch and we’d be happy to help you out.

Interested in working with us?

Tell us about your legal issue and we’ll put together a fixed fee quote for you.

Previous

Previous